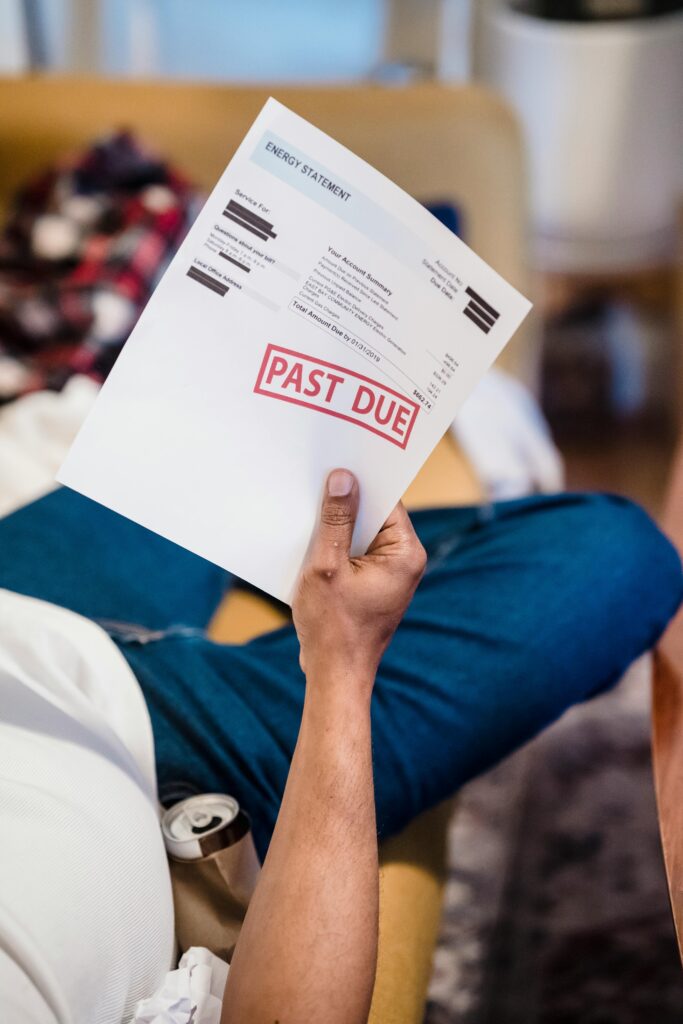

HOW FINANCIAL INFIDELITY CAN DESTROY YOUR MARRIAGE AND HOW TO PROTECT YOURSELF

Financial infidelity has destroyed many marriages. It can come in many forms. Sometimes, your spouse may be too embarrassed to tell you about a job loss, a failing business, or an unexpected disability. Perhaps, your spouse ran up credit cards without your knowledge for personal luxuries, like clothes and jewelry, or to support an adulterous relationship.

It could be drug or gambling debts. Worse yet, maybe, he or she stole your identity to open credit card accounts under your name. Even more shocking, your spouse may be hiding a mortgage foreclosure or even a pending sheriff’s sale. If you suspect that your spouse has committed financial infidelity, you need to know your rights and your obligations to the creditor and your spouse for personal and joint, marital debt. They depend first depend on whether they are your debts, your spouse’s debts, or your marital debts. They will also depend on whether you are divorcing or being pursued by creditors.

Your Obligation for Individual Debts

When it comes to creditors, only you and not your spouse are legally responsible for your own individual debts, such as your credit cards. You are not responsible for your spouse’s individual debts. You and your spouse are, however, legally obligated to pay your joint debts, such as a mortgage on your home. So, joint creditors can attack your individually owned property, including bank accounts, to pay for joint debts.

Pennsylvania law distinguishes between individual debt and joint marital debt because, your marriage is a separate legal entity that stands apart from you as an individual. In other words, a marriage results in three distinct separate legal units: you, your spouse, and your marriage. Pennsylvania law makes this distinction specifically to protect you and your family from the ravages of your partner’s financial infidelity!

Legally therefore, your joint assets are protected from your spouse’s creditors. They cannot force a sale of any asset that you own together as spouses. Of course, joint creditors can go after your joint assets, like your home. While these obligations to creditors remain valid when financial infidelity leads to divorce, a divorce can change who is responsible for those debts between you and your spouse.

Your Obligation for Marital Debts

In divorce, your financial obligations fundamentally depend on whether the debts were incurred before your marriage, during marriage, or after separation and divorce.

Pennsylvania’s divorce laws do not hold you responsible for debts that your spouse had before you married or that he or she incurred after you separated and later divorced. Likewise, your spouse is not responsible for your pre-marital debts, your post-separation, or post-divorce debts. In contrast, a divorce may make you responsible for debts that your spouse signed for individually during the marriage and before your separation. Your total debt at the end of a divorce, regardless of whether the debt is yours, your spouse’s, or joint, ultimately depends upon the Court’s decree for equitable distribution or on how you and your spouse divide them in a property settlement agreement.

As noted in our blog, “What is a Marital Asset?,” there are many factors, both well-established and novel, that will determine how responsibility for your marital debts will be divided. Financial infidelity, innocent or not, will be a major factor in shifting the responsibility for debts in your name back to your spouse. There are other reasons for shifting responsibility, though. One example is a student loan that was used for documented household expenses and not for tuition payments. When this occurs, the other spouse may have to pay the debtor spouse or the lender directly even though the debtor spouse will remain primarily responsible to the lender for paying it back.

Protecting Yourself When You Suspect Financial Infidelity

When you suspect financial infidelity, you need to act quickly to protect yourself from your spouse’s debts. Here are some steps you should take to protect yourself.

- Stop your spouse from using your credit cards by ending your spouse’s authorized use of them. Simply call the credit card company and tell them that your spouse is no longer authorized to use your credit and, most importantly, have them issue you a new card with a new account number. This easy move will prevent your spouse from using your on-line accounts, like Amazon, too. Do not share this new card with your spouse.

- Open a separate bank account if you do not have one already. Then, have your employer deposit your wages or salary directly into that account. Now you, not your spouse, will control what you do with your money.

- Review statements for your bank, mortgage, loans, and credit card accounts. Challenge suspicious transactions by reporting them to the fraud departments.

- Get your credit report. Review it for loans accounts that you do not recognize. Make sure the balances are correct. While it is illegal for you or your attorney to try to get a copy of your spouse’s credit report without consent, you can ask your spouse for permission. Your spouse’s credit report will show how much and to whom your spouse is indebted. You can ask your spouse for the report as a routine precaution against fraudulent creditors.

- Search online for lawsuits and judgments against you and your spouse.

- Change passwords for financial accounts and your computer and cell phone lock screens to keep your spouse from accessing them.

The impacts of financial infidelity on your credit and your future economic security can be devastating and long-lasting. An experienced attorney can help you to overcome them. If you suspect that your spouse has committed financial infidelity or have any questions about your responsibility for marital debt and repairing the damage done, please contact Shintia Riva, Esquire at the Law offices of Spadea & Associates, LLC for free consultation at 610-521-0604.

Speak Your Mind